- LifeVest Newsletter - Build Wealth Protect Wealth

- Posts

- 2 Stocks Surge - Don't Miss Out

2 Stocks Surge - Don't Miss Out

Intel Soars and Tik Tok Deal Seal

Introduction

Welcome to this week’s edition of Top Stock Market Highlights — your guide to the stories shaping tomorrow’s portfolios.

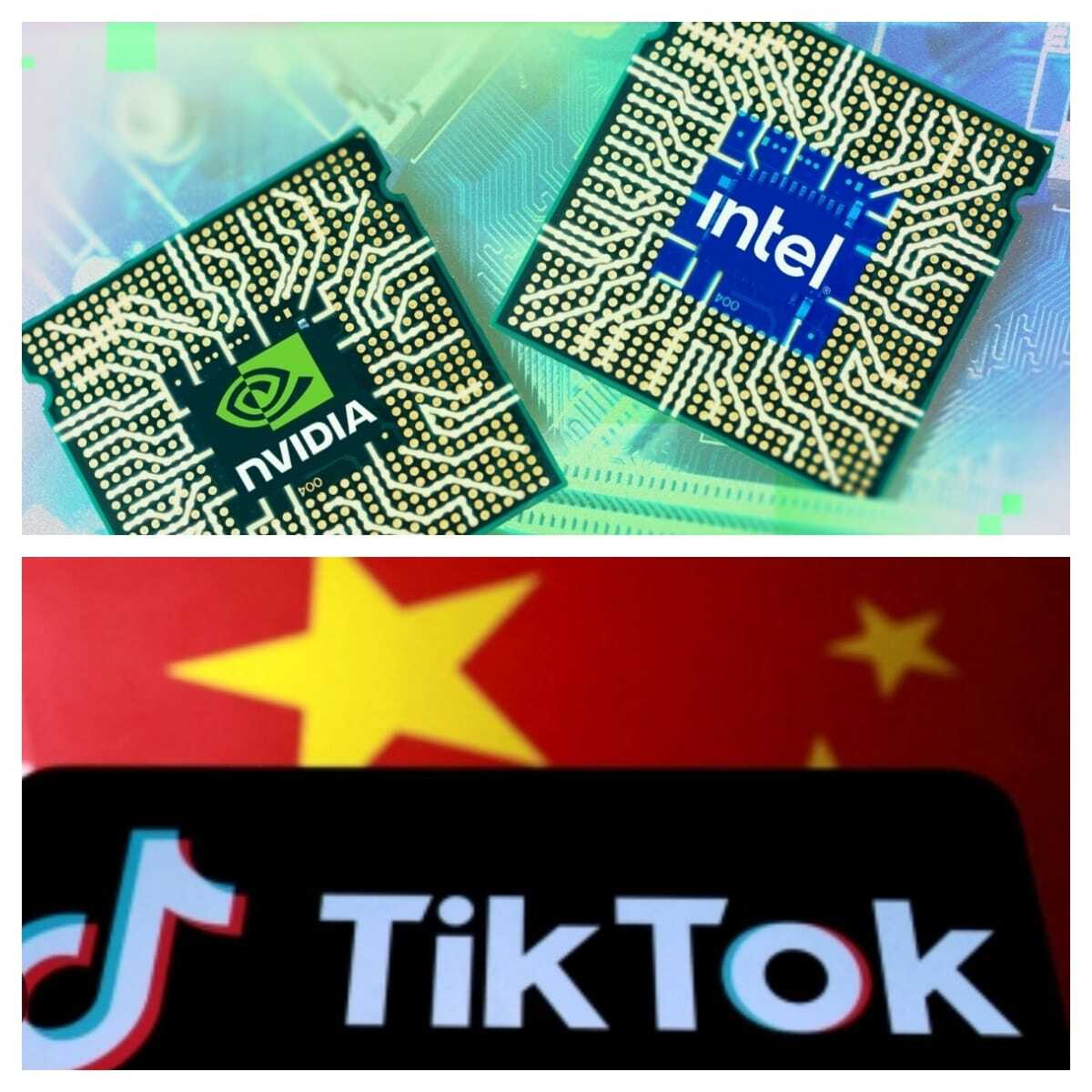

In a week packed with market-moving news, Intel stunned Wall Street with its strongest trading day in nearly four decades, powered by a bold US$5 billion investment from Nvidia — a move that could redefine the balance of power in semiconductors. Meanwhile, US–China negotiations over TikTok’s American operations appear to be gaining real traction, raising the stakes for investors across the tech and media landscape.

These aren’t just headlines — they’re signals of where capital, competition, and opportunity are converging.

Join 400,000+ executives and professionals who trust The AI Report for daily, practical AI updates.

Built for business—not engineers—this newsletter delivers expert prompts, real-world use cases, and decision-ready insights.

No hype. No jargon. Just results.

1. Intel Soars as Nvidia Bets US$5 Billion on Its Comeback

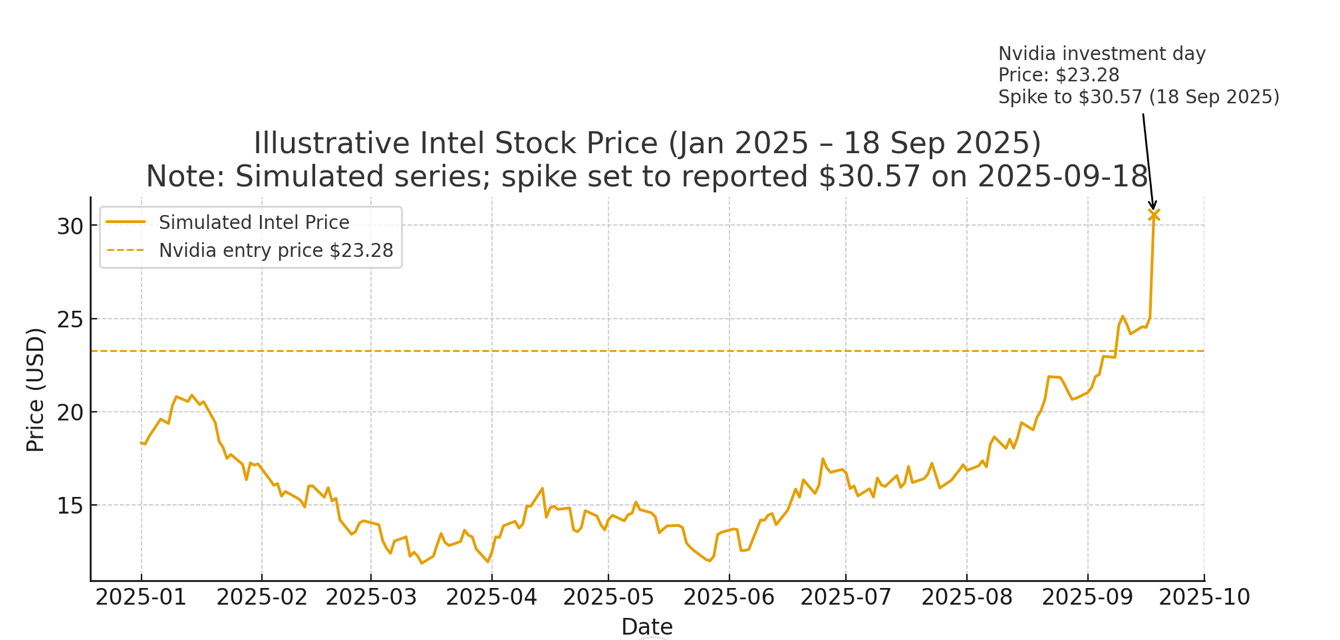

Intel shares exploded on 18 September 2025, logging their best trading day since October 1987. The stock jumped about 22.8% to US$30.57, following the announcement that Nvidia would invest US$5 billion into Intel.

Key Details & What It Means

Investment terms: Nvidia is acquiring Intel shares at US$23.28 per share, giving it around a 4% stake in Intel.

Strategic alliance: The deal is structured as more than financial—Nvidia and Intel will co-develop data center and PC chips:

Intel will manufacture x86 CPUs for Nvidia's AI infrastructure.

They plan to build x86 system-on-chips (SoCs) that integrate Nvidia’s RTX GPUs for PCs.

This alignment ties Nvidia’s AI/GPU stack more closely to Intel’s CPU and ecosystem.

Government stake: Prior to this, the U.S. government bought a ~9.9% stake in Intel for US$8.9 billion, paying US$20.47 per share. After the surge, that 10% stake would be worth about US$13.2 billion, reflecting significant paper gains.

Other backers: SoftBank also put in US$2 billion earlier.

Corporate restructuring: Under new CEO Lip-Bu Tan, Intel has been undergoing deep restructuring—cutting workforce, exiting non-core businesses, and refocusing on core chip and manufacturing operations.

What to Watch & Risks

Technical & execution risk: Intel’s foundry business (making chips for others) has long struggled to attract leading-edge clients and consistently deliver at cutting-edge nodes. This partnership doesn’t immediately resolve those issues.

Valuation pressure: The stock’s spike may overshoot fundamentals in the short term—investors will want to see consistent revenue, margins, and execution supporting the optimism. Some analysts caution that the market’s enthusiasm may be premature.

Geopolitical & regulatory sensitivity: Because of its strategic importance, Intel is under scrutiny. Any missteps in policy, export controls, or political fallout (especially with government ownership involved) could trigger volatility.

Dependence on partner alignment: The success depends heavily on Nvidia’s continued support and synergy in developing chip designs and managing production flows.

Summary for Investors

This deal is a major vote of confidence in Intel’s turnaround—beyond capital, it brings alignment with one of the most powerful players in AI. The share price rally reflects market optimism, but the real test will be execution, sustained revenue growth, and margin expansion.

If Intel can successfully convert this momentum into consistent performance, this may mark the beginning of a meaningful rebound—not just a one-day spike.

Turn AI Into Your Income Stream

The AI economy is booming, and smart entrepreneurs are already profiting. Subscribe to Mindstream and get instant access to 200+ proven strategies to monetize AI tools like ChatGPT, Midjourney, and more. From content creation to automation services, discover actionable ways to build your AI-powered income. No coding required, just practical strategies that work.

2. TikTok’s Nears Breakthrough Deal: US Investors to Control 80% Stake

Major progress finally emerged in the long-running saga over TikTok’s U.S. operations as negotiators from Washington and Beijing hammered out a framework that could fundamentally reshape the social media giant’s American presence.

At the heart of the deal — discussed during this week’s trade talks in Madrid — is a new U.S. entity structured so that American investors hold ~80%, while Chinese shareholders retain ~20%.

A consortium led by Oracle, alongside Silver Lake and Andreessen Horowitz, has stepped forward as anchor backers — though stocks like Oracle saw a 1.59% decline on the announcement. Existing ByteDance backers such as KKR, General Atlantic, and Susquehanna International are also expected to participate.

Under the proposed plan, existing U.S. users will migrate to a new, standalone TikTok app built specifically for the American market. Oracle is slated to house all U.S. user data in its Texas infrastructure, while TikTok engineers will recreate the recommendation algorithm—licensed from ByteDance—for domestic use. The entity’s governance will be dominated by Americans, with six of seven board seats held by U.S. citizens, and one seat appointed by the government.

President Trump announced the breakthrough, noting he would consult with Chinese President Xi Jinping to finalize details. He also extended enforcement of the TikTok ban to December 16, giving time for the transaction to clear. Meanwhile, a senior Chinese cyberspace regulator confirmed that both sides have reached "basic consensus" on licensing algorithm and IP rights for the U.S. operation.

Why It Matters

Under existing laws, TikTok faced a forced divestment or blackout after failing to comply with divestiture deadlines.

The valuation comes in at approximately US$14 billion, significantly below some earlier estimates — reflecting the complexity of the structural carve-out.

TikTok currently reaches over 170 million monthly U.S. users — making it one of the most visited apps in the country.

The deal is widely viewed as a strategic pivot in the tech cold war between the U.S. and China — a test case for how tightly intertwined technology, data, and sovereignty have become.

While many details remain to be finalized — algorithm licensing, data access, board rights, and regulatory compliance — this deal signals a breakthrough after months of paralysis. If executed well, it could set a precedent for how future cross-border tech platforms manage national security concerns and global reach.

Conclusion

What Investors Should Watch Next

The past week delivered a clear reminder that tectonic shifts in technology are often driven by both innovation and geopolitics. Intel’s historic rebound, powered by Nvidia’s US$5 billion vote of confidence and strong U.S. government backing, shows how legacy players can reinvent themselves and re-enter the growth race. Meanwhile, TikTok’s breakthrough framework underscores how political compromise can unlock new opportunities for global tech firms navigating regulatory headwinds.

For investors, three key takeaways stand out:

Partnerships matter – Nvidia’s tie-up with Intel illustrates how collaboration can accelerate growth and transform industry dynamics.

Policy is a catalyst – U.S. government stakes in chipmakers and regulatory deals like TikTok’s restructure can rapidly reshape valuations.

Volatility creates opportunity – what looks like a setback today may be tomorrow’s breakout story, as Intel’s record trading day demonstrates.

In short, the companies best positioned to thrive will be those that can balance technological innovation with geopolitical realities — and savvy investors who pay attention to both will be better equipped to capture the upside.

Happy Investing!!

Recommended Resources

Before diving into options trading, beginners should take time to learn and practice paper trading. While the lower cost of options trading can be appealing, it comes with higher risks that need careful management.

If you want to benefit from options trading, consider this online course conducted by Sean Seah, an International Speaker and Best Selling Author on the topic of Investing and Entrepreneurship. He is featured on Channel News Asia, News Papers, Radio and Investment Magazines. He is also frequently invited to conferences and shared the same stage as Richard Branson, Mary Buffett, Gary Vee, Steve Wozniak and many more.

Unlock Your Potential with Sean's Proven Options Strategies - The Ultimate Options Strategy Guide for Beginners

Dive into a curated collection of options strategies tested by Sean himself, complete with real case studies! This self-paced online course starts now and never ends—you set your schedule and progress at your own pace.

How long do you have access to the course?

How does lifetime access sound? Once you enrol, you’ll have unlimited access to the course across all your devices, anytime you want. Start learning today and unlock your potential in the exciting world of options trading!

An Investment into Your Financial Freedom is Your gateway to mastering the art of investing without wasting countless hours on dull webinars. With the Super Investor Club, you’ll gain the knowledge and strategies you need to make confident investment decisions and achieve true financial freedom. Join a community that’s as committed to your success as you are—because this isn’t just a membership; it’s an investment in your future. 💰💰

See what our members have to say!

Disclaimer: The information provided in this article is for educational and informational purposes only and should not be construed as investment advice. The views expressed are those of the author and do not necessarily reflect the official policy or position of any company. Readers should do their research before taking any actions related to the content. The author and publisher are not liable for any losses or damages caused by following any advice or information presented herein. Unveiling the Secrets of Growth Stock Investing!