- LifeVest Newsletter - Build Wealth Protect Wealth

- Posts

- 3 Game-Changing ETFs Every Young Investor Must Know!"

3 Game-Changing ETFs Every Young Investor Must Know!"

Unlock Your Wealth

Introduction

Picture this: You, young and eager, stepping into the world of investment, armed with a smartphone and a burning desire to make your money work for you. But where do you start? Fear not, dear reader, for the world of Exchange-Traded Funds (ETFs) awaits, offering a pathway to wealth that's both accessible and exhilarating. Today, we embark on a journey to uncover the five ETF gems that will set you on the path to financial success!

Overview

In this thrilling adventure, we'll delve into the realm of ETFs, shining a light on why they're the ultimate choice for budding investors. From the tried-and-tested S&P 500 champions to the exhilarating realm of tech-centric Nasdaq-100 ETFs, we've got you covered. Get ready to discover how ETFs can turbocharge your investment portfolio while keeping costs low and effort minimal!

🚀 1. The S&P 500 Titans: Your Golden Ticket to Prosperity

Imagine stepping into the stock market casino, the air thick with anticipation. You're not just a spectator; you're a player. And your high-rolling chips? They're none other than the S&P 500 index ETFs – the crème de la crème of the US economy. Picture Apple, Microsoft, and Amazon strutting their stuff like Wall Street rockstars. These are the champions you're “betting on”.

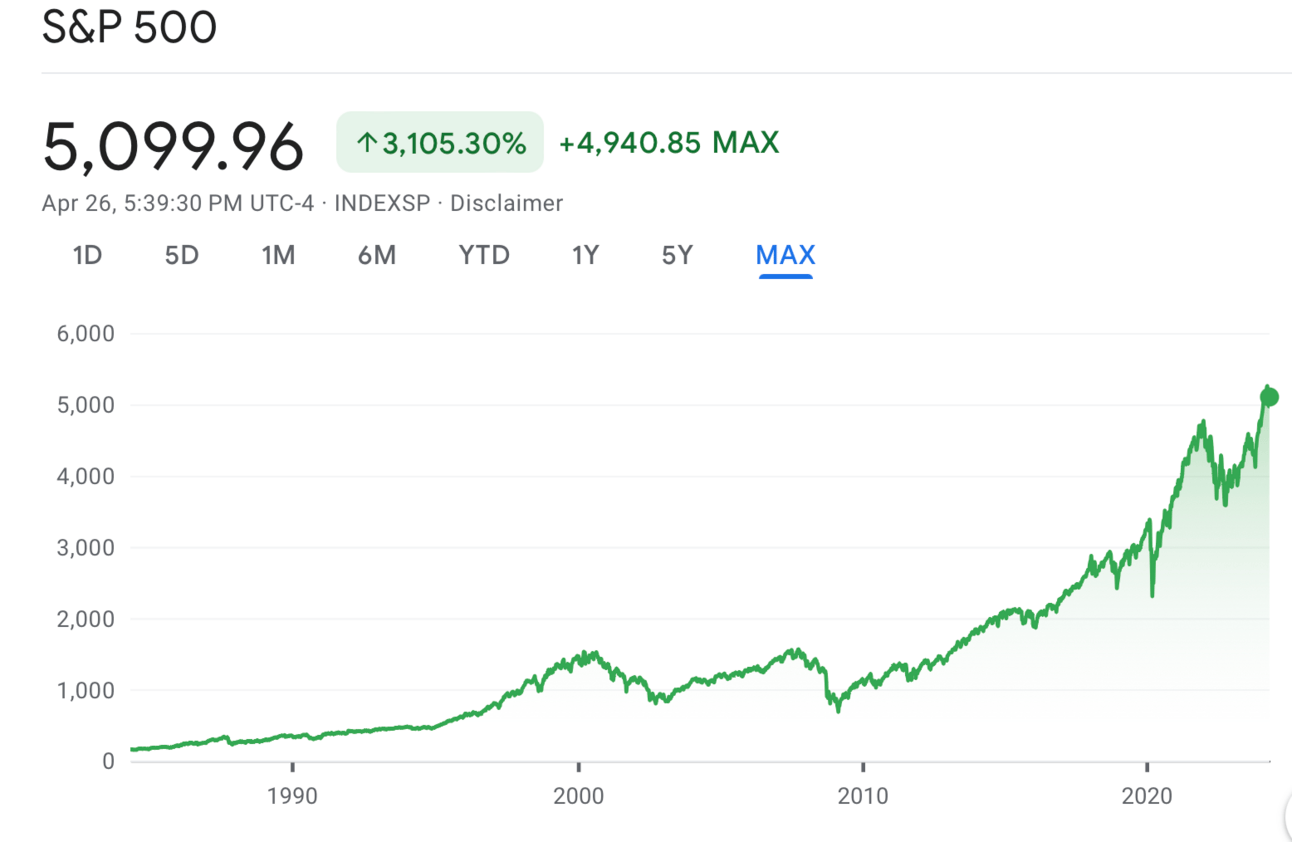

Now, let's talk returns. Brace yourself for this: 10%. That's the jaw-dropping annual return these ETFs have delivered over the years. A humble $10,000 invested a decade ago could've ballooned into a cool $29,000. Minimal effort, maximum gains – it's like stumbling upon a unicorn at a garage sale!

The Classic S&P 500 Index: Your Reliable Ride

Think of the S&P 500 as that trusty car – not flashy, won't win races, but oh-so-dependable. It won't break down in the middle of the highway. For first-time investors, this reliability is gold. It's the peace of mind that fuels confidence and stokes your risk appetite. Because let's face it, investing can be nerve-wracking.

What's Under the Hood?

The S&P 500 tracks the top 500 companies in the US. It's the benchmark of the US economy itself. When you invest in this ETF, you're essentially backing the best companies – not just in the US, but globally. Now, there are several ETFs tracking this index, but let's focus on four main players:

1. VOO: Vanguard S&P 500 ETF

2. SPLG: SPDR Portfolio S&P 500 ETF

3. IVV: iShares Core S&P 500 ETF

4. SPY: SPDR S&P 500 ETF Trust

They all do the same thing – mirror the S&P 500. But they're like siblings with different personalities. Their expense ratios, assets under management, and tracking accuracy may vary slightly. Yet, they're more than 99.9% identical. Their top holdings? The usual suspects: Apple, Microsoft, Amazon, Nvidia, and Alphabet

The Numbers Don't Lie

Let’s talk returns. Brace yourself again:

- 3-Year Return: Around 8.4%

- 5-Year Return: Approximately 10.9%

- 10-Year Return: A solid 11.2%

The Cost of Admission

Now, the nitty-gritty. Fees matter. VO and SPY are the big players here. Their expense ratios dance between 0.02% and 0.09%. Let's break it down: Say your return this year is 5%. With a $10,000 investment, SPLG would give you around $497 after fees, while SPY would yield about $491. Doesn't sound like much? Think long term. Keep adding, let it compound, and watch those dollars snowball.

So, grab your golden ticket, hop on the S&P 500 express, and ride toward prosperity.

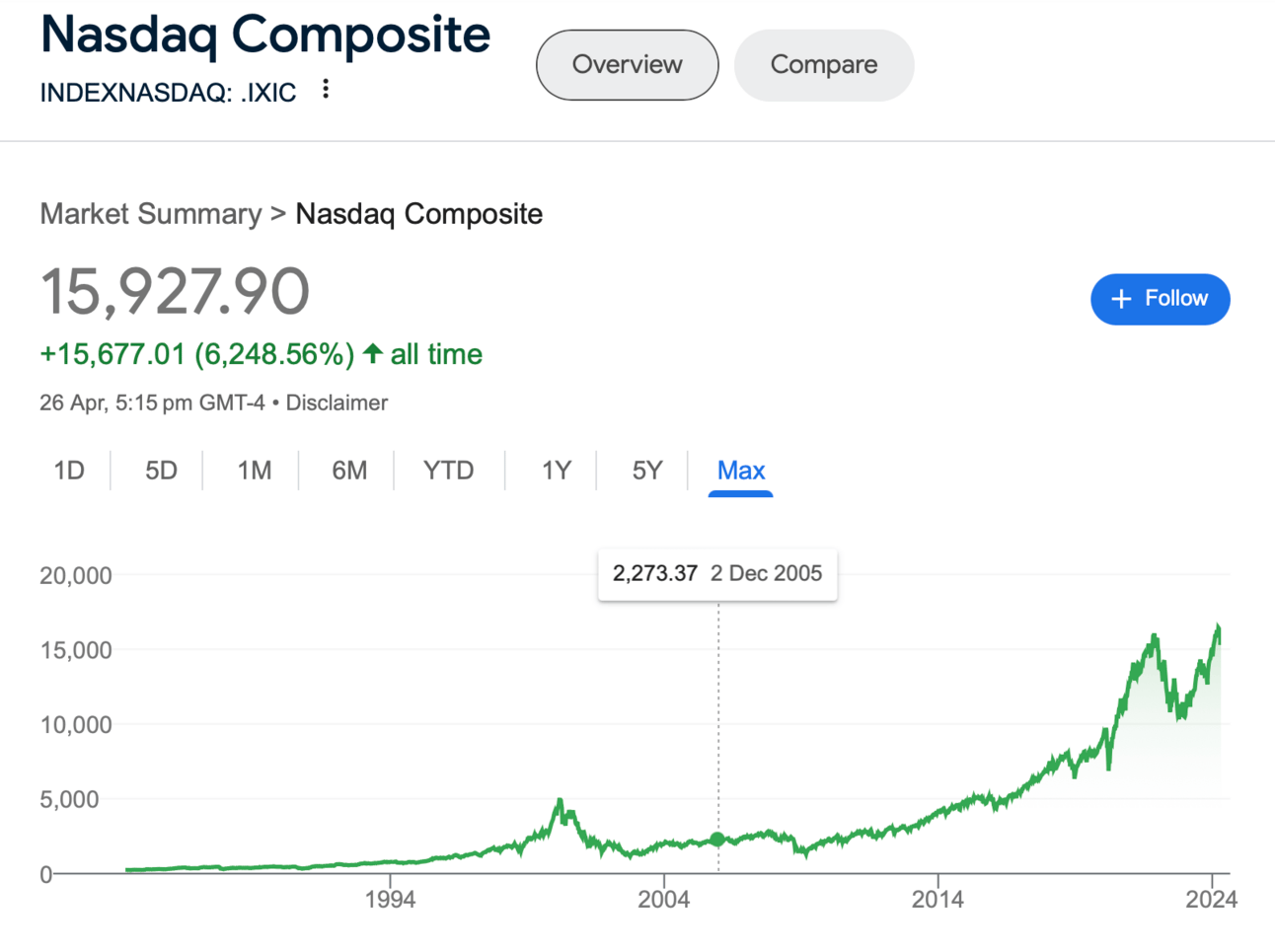

🚀 2. The Nasdaq - 100 Index: Unleashing Tech Titans

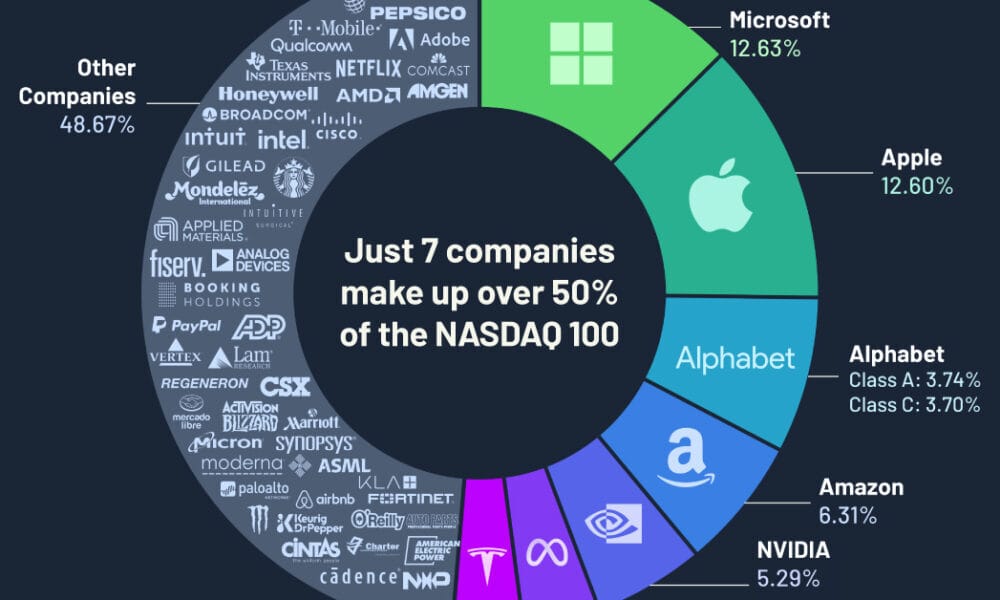

The Nasdaq-100 index comprises 100 of the largest and most actively traded non-financial companies listed on the US Nasdaq Stock Exchange. What sets it apart? A high weightage on US technology stocks, which have historically experienced explosive growth rates. Think of it as a powerhouse of innovation, fuelled by giants like Apple, Microsoft, Amazon, Nvidia, and Meta etc.

The Tech Boom and Its Volatile Dance

The Nasdaq-100's focus on tech titans means it's a playground for growth enthusiasts. But remember, with great growth comes equally high volatility. Buckle up for the roller coaster ride! While the S&P 500 may seem similar, the Nasdaq-100 excludes financial companies like JP Morgan, Bank of America, and Visa. It's a tech-centric party, and everyone's invited.

Meet the Stars: QQQ and QQQM

- QQQ (Invesco QQQ Trust)

*Assets Under Management (AUM): Enormous.

*Expense Ratio: Reasonable.

*Performance: Staggering!

Check out its *5-year and 10-year returns—a jaw-dropping **16%+ per annum*. Who wouldn't love that?

- QQQM (Invesco NASDAQ 100 ETF)

*The Little Brother: QQQM is like QQQ's younger sibling.

*Smaller AUM: But don't let that fool you. It's leaner and meaner.

*Expense Ratio: A wallet-friendly *0.15%*.

*Liquidity Alert: Smaller AUM means *lower liquidity*, affecting active traders more than long-term investors. But for the latter, it's a minor concern.

So there you have it! Whether you're a tech enthusiast or a dividend lover, the Nasdaq-100 ETFs offer something for everyone. Remember, investing is a marathon, not a sprint. Buckle up, embrace the volatility, and let your portfolio soar!

🚀3. Dividend ETFs: A Steady Path to Financial Stability

When it comes to investing, the allure of high-growth tech stocks can be irresistible. However, for those seeking a safer haven, dividend exchange-traded funds (ETFs) offer a compelling alternative. In this article, we'll delve into two dividend ETFs—Vanguard Dividend Appreciation Index Fund ETF(VIG) and Schwab U.S. Dividend Equity ETF (SCHD)—that provide stability, consistent income, and peace of mind.

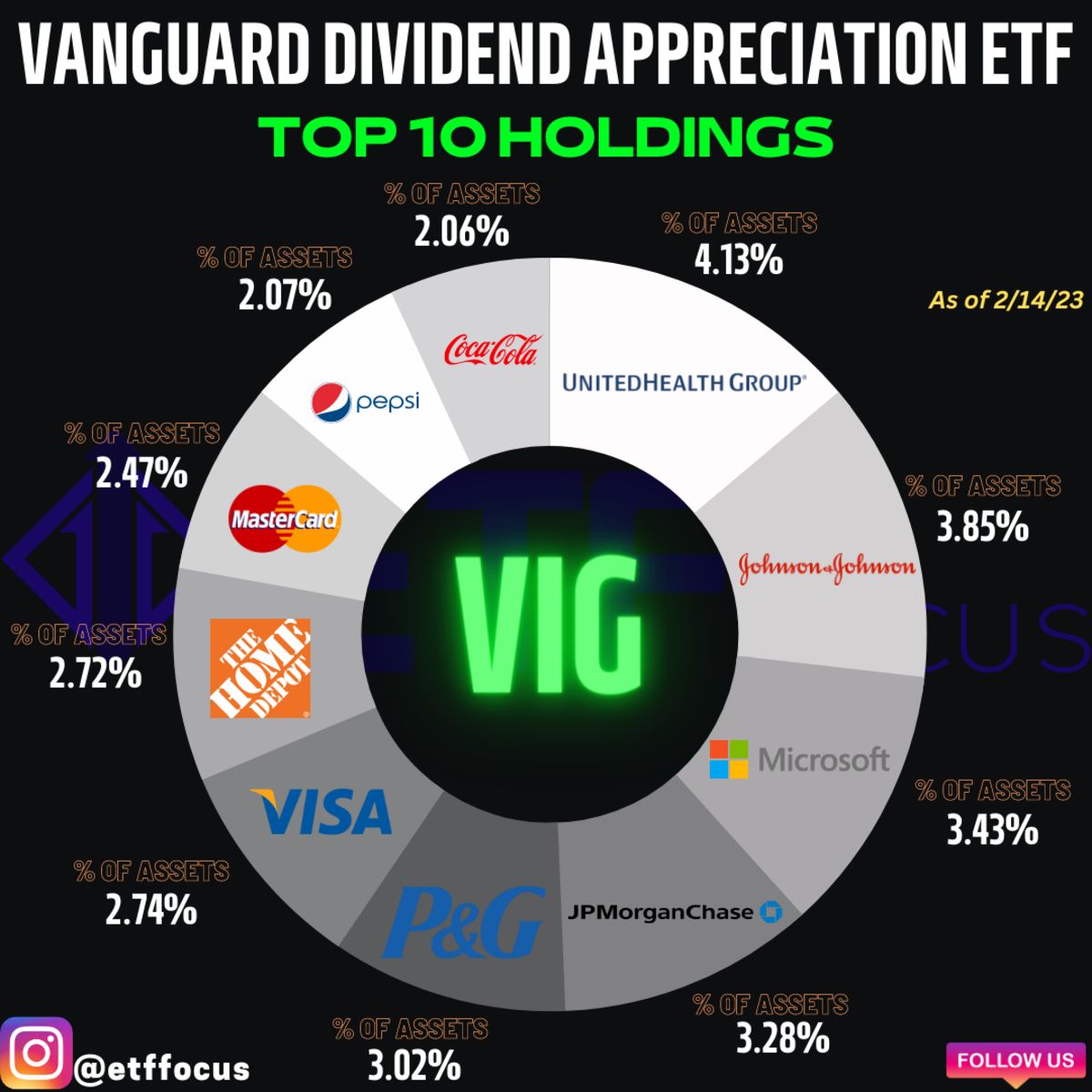

Vanguard Dividend Appreciation Index Fund ETF (VIG): The Dividend Aristocrat

VIG focuses on companies with a remarkable track record: a decade or more of consecutive dividend increases. These firms have weathered economic storms, demonstrating resilience and financial strength. Here's why VIG deserves your attention:

-Stability: VIG's holdings consist of established companies that weather market volatility better than high-growth stocks. Think of them as the "dividend aristocrats."

-Top Holdings companies such as Microsoft, Apple, Aon, UnitedHealth,

JPMorgan Chase Bank etc.

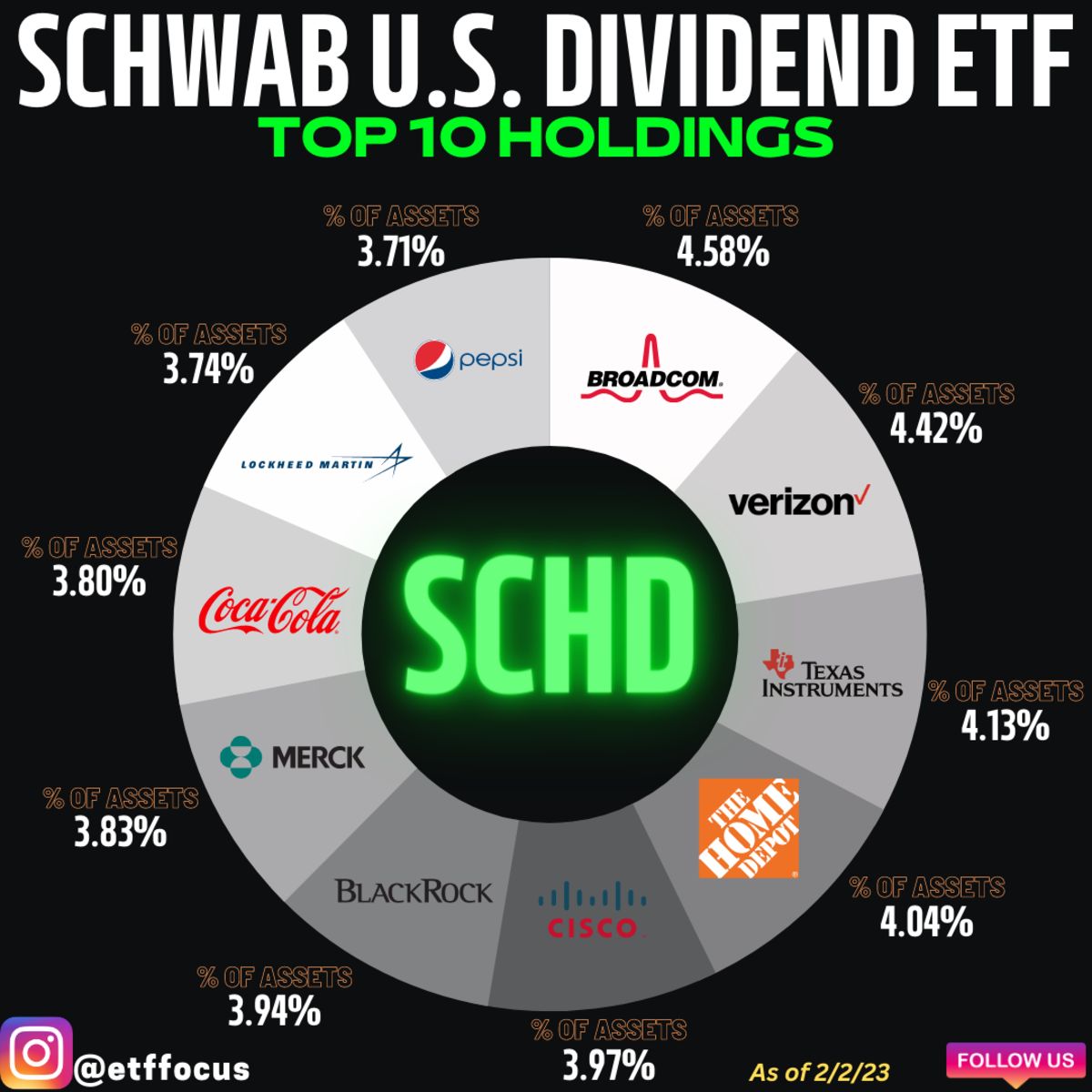

Schwab U.S. Dividend Equity ETF (SCHD): Tracking the Dividend Titans

SCHD tracks the Dow Jones U.S. Dividend 100 Index, composed of companies that consistently pay dividends. These firms are financially robust and mature. Here's why SCHD stands out:

- Financial Strength: SCHD's holdings are giants in their respective industries. They generate substantial profits, making dividend payments sustainable.

- Top Holdings companies like MG: A biotech firm, FV: A pharmaceutical company, Chevron: An energy giant, Broadcom: A semiconductor leader, Merck & Co.: Another pharmaceutical heavyweight etc.

The Dividend Illusion: A Cautionary Note

Before diving in, consider these critical points:

-Dividend Yield Isn't Everything: A soaring dividend yield doesn't always indicate a healthy investment. Beware of companies increasing payouts without corresponding earnings growth.

-Reinvestment Matters: Companies must balance dividends with reinvesting in their businesses. If dividends consume too much, innovation suffers, and competitors gain an edge.

Performance and Expense Ratios

- Three-Year Returns:

*SCHD: Outperformed VIG with a solid 9% annual return.

*VIG: Still respectable, averaging 6-7% annually.

- Expense Ratios:

*Both VIG and SCHD charge approximately 0.06% per annum.

- Dividend Yields:

*VIG: 1.95%

*SCD: A robust 3.9%

🎯4. The Dividend ETF Expedition: Pros and Cons

Advantages of Dividend ETFs:

Steady Income Stream : Imagine dividends as a gentle rain – consistent, refreshing, and oh-so-welcome. These ETFs serve up regular portions of cash from the companies they hold. Whether you're buying a latte or planning your retirement villa, those dividends keep the party going.

Safety First: Dividend ETFs are like the sensible friend who always wears a seatbelt. They're widely considered safer than other investments. Why? Because companies that pay dividends tend to be stable and battle-tested. No wild rollercoaster rides here!

Diversification Delight: These ETFs spread their love across various sectors. It's like having a buffet with sushi, tacos, and gelato – all in one plate. You're not putting all your eggs in one corporate basket.

Inflation Hedge: When inflation knocks on your financial door, dividend ETFs offer a sturdy shield. They're like Gandalf saying, "You shall not pass!" against rising prices.

Risks of Dividend ETFs

Market Volatility: Picture a stormy sea. The value of dividend ETFs can sway with market conditions and the performance of the underlying stocks. If the stock market does the cha-cha, your ETF might join the dance.

Sector Concentration Danger: Some dividend ETFs may be obsessed with certain sectors. Imagine a ship loaded with tech stocks – if the tech sector hits an iceberg, your ETF might shiver. Diversify, my friend!

Dividend Disasters: Brace yourself. One or more companies in your ETF's portfolio might decide to cut their dividends. It's like a magician pulling a disappearing act with your revenue stream. Poof!

Conclusion: The Final Cliffhanger

So, fellow investor, tread carefully. Dividend ETFs are like hiking rugged trails – breathtaking views, but watch out for loose rocks. Choose wisely, diversify, and remember: Life's an adventure, and your portfolio is the treasure map. 🗺️💰

🌟Final Thought:

If investing were a movie, dividend ETFs would be the plot twist you didn't see coming. Happy investing! 🚀📈

For further insights and personalized investment guidance, Subscribe to our newsletter and Receive Your FREE 7-Step Checklist with investing insights for Young Investors. Plus Bonus-new article will be sent to your email instantly whenever they launch 🚀🌟

Disclaimer: The information provided in this article is for educational and informational purposes only and should not be construed as investment advice. The views expressed are those of the author and do not necessarily reflect the official policy or position of any company. Readers should do their own research before taking any actions related to the content. The author and publisher are not liable for any losses or damages caused by following any advice or information presented herein.