- LifeVest Newsletter - Build Wealth Protect Wealth

- Posts

- Market's Surging: Your Next Move...

Market's Surging: Your Next Move...

Invest, Sell, or Wait...

Start investing right from your phone

Jumping into the stock market might seem intimidating with all its ups and downs, but it’s actually easier than you think. Today’s online brokerages make it simple to buy and trade stocks, ETFs, and options right from your phone or laptop. Many even connect you with experts who can guide you along the way, so you don’t have to figure it all out alone. Get started by opening an account from Money’s list of the Best Online Stock Brokers and start investing with confidence today.

Introduction

When your portfolio’s all green and markets are climbing higher every week, it feels great like everything you’ve invested in is finally paying off.

But that’s usually when the doubt sneaks in.

Should you buy more and keep riding the wave?

Take some profit before things turn?

Or wait for a correction that may never actually come?

If you’ve been asking yourself those questions lately, you’re definitely not alone. Many investors are feeling the same mix of excitement and unease right now.

Because when markets hit record highs and everyone seems to be making money, it’s easy to forget one simple truth, the goal isn’t to time the market. It’s to stay in the market, with the kind of businesses that can grow, pay dividends, and quietly compound your wealth through every cycle.

1. Don't Miss What You’ve Been Waiting For

When it comes to consistency, a few stock names have quietly proven that patience truly pays.

Take Johnson & Johnson — a global healthcare giant with a history of stability and dividends stretching back decades. Despite market ups and downs, J&J has increased its dividend for over 60 consecutive years, earning its place as a Dividend King. Its diversified business include spanning pharmaceuticals, medical devices, and consumer health that gives it the steady earnings power investors crave when volatility hits.

Or look at PepsiCo — a household name that’s more than just snacks and soda.

PepsiCo has raised its dividend for 52 straight years, backed by strong cash flow and resilient global demand. Even during uncertain times, its portfolio of everyday brands like Lay’s, Quaker, and Gatorade keeps the company’s growth engine running smoothly.

Both companies prove the same timeless lesson:

Markets change, trends fade, but quality businesses with strong brands and steady cash flow keep delivering year after year.

2. Staying Grounded in a Hot Market

Here’s how we should think about it

When a company’s fundamentals remain strong, consistent earnings, healthy cash flow, and reliable dividends, there’s rarely a good reason to sell simply because the price has gone up. Strength should be rewarded with patience, not panic.

If you’re looking to add new positions, focus on purpose and balance

Does this investment improve your diversification?

Does it strengthen your income stream or make your overall portfolio work harder for you?

And if one stock has grown too large or its fundamentals start to weaken, a thoughtful trim or rebalance can help keep your portfolio healthy without disrupting your long-term strategy.

Above all, stay grounded. Market highs can tempt you to act, but discipline is what keeps wealth compounding. Focus on the quality of what you own, not the noise of where prices happen to be today.

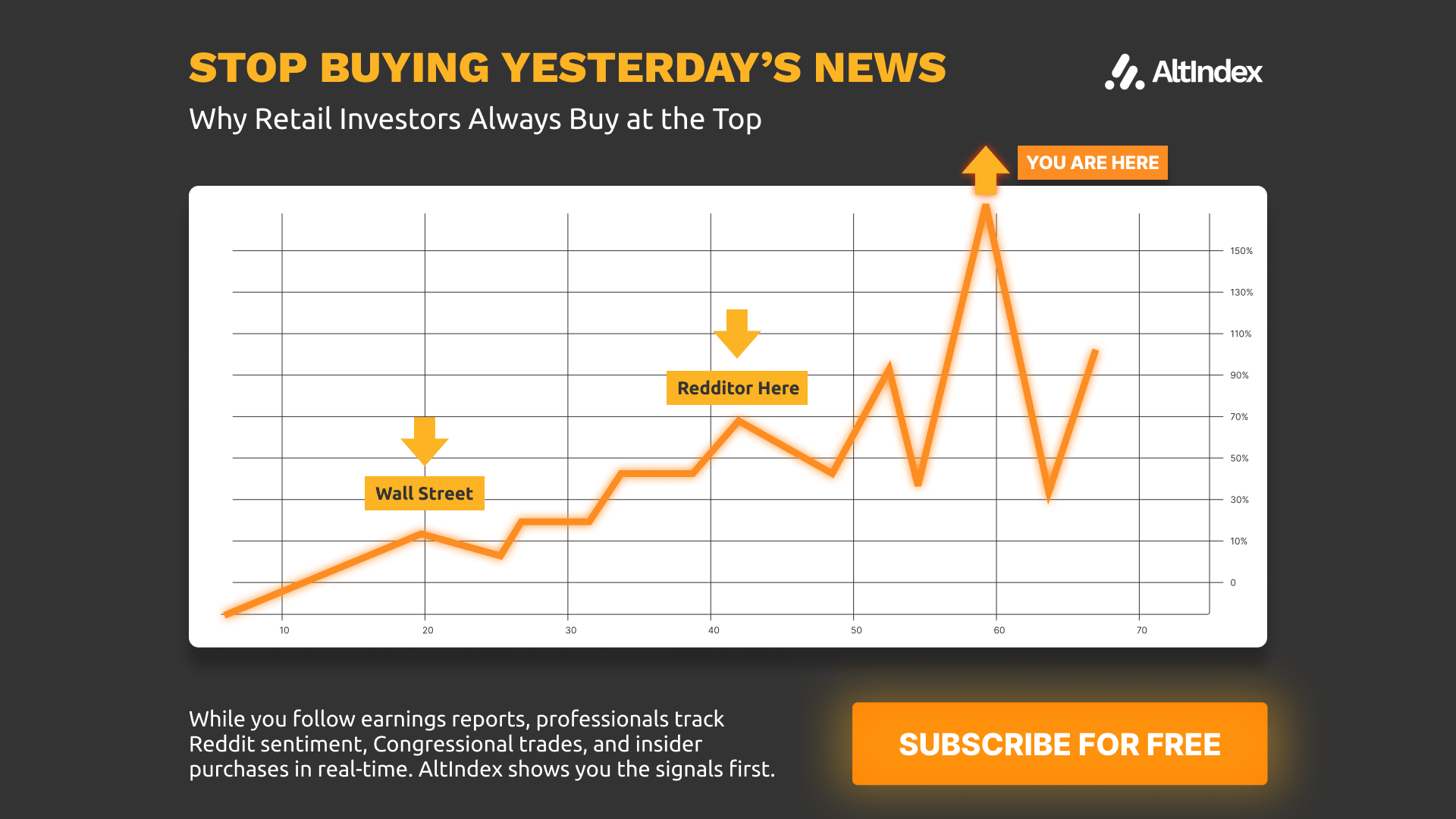

When AI Outperforms the S&P 500 by 28.5%

Did you catch these stocks?

Robinhood is up over 220% year to date.

Seagate is up 198.25% year to date.

Palantir is up 139.17% this year.

AltIndex’s AI model rated every one of these stocks as a “buy” before it took off.

The kicker? They use alternative data like reddit comments, congress trades, and hiring data.

We’ve teamed up with AltIndex to give our readers free access to their app for a limited time.

The next top performer is already taking shape. Will you be looking at the right data?

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

Building a dividend portfolio that stands the test of time starts with quality, reliability, and balance. The portfolio should be carefully selected for its ability to deliver reliable dividends and long-term growth, providing a foundation that can weather both market rallies and downturns.

Some holdings should be steady income generators, companies with a long track record of increasing dividends year after year — think Johnson & Johnson, whose diversified healthcare business has rewarded investors with decades of consecutive dividend growth. Others can offer measured growth, such as PepsiCo, whose global brands and resilient cash flow provide both stability and upside potential.

The key to building a smart dividend portfolio isn’t about chasing the latest high-flying stock or trying to time the market. It’s about choosing businesses with durable fundamentals, holding them for the long term, and letting dividends accumulate and compound over time. A well-constructed dividend portfolio not only provides income, but also allows your wealth to grow steadily, quietly, and predictably.

When adding new positions, ask yourself:

Does this stock improve your diversification?

Does it strengthen your income mix?

Does it make your portfolio work harder for you?

These are the questions that keep your portfolio purposeful and resilient.

And if one holding grows too large or its fundamentals change, trimming or rebalancing can be a smart, disciplined move ensuring that no single stock dominates your portfolio or exposes you to unnecessary risk.

At the end of the day, investing isn’t about chasing every headline or timing the next market peak. It’s about staying disciplined, focusing on quality, and giving time the chance to work its magic.

A well-constructed dividend portfolio allows you to capture growth, generate income, and let compounding quietly build wealth year after year. The stocks you choose today, held with patience and conviction, become the foundation of your financial future.

So as markets reach new highs, remember this: success isn’t measured by short-term gains, but by the steady accumulation of wealth over time.

Invest in quality, collect your dividends, and let time your most powerful ally do the rest.

Happy Investing!!

Disclaimer: The information provided in this article is for educational and informational purposes only and should not be construed as investment advice. The views expressed are those of the author and do not necessarily reflect the official policy or position of any company. Readers should do their research before taking any actions related to the content. The author and publisher are not liable for any losses or damages caused by following any advice or information presented herein. Unveiling the Secrets of Growth Stock Investing!