- LifeVest Newsletter - Build Wealth Protect Wealth

- Posts

- Top AI Stocks to Watch Right Now...

Top AI Stocks to Watch Right Now...

Worth Buying Stocks

It's not you, it’s your tax tools

Tax teams are stretched thin and spreadsheets aren’t cutting it. This guide helps you figure out what to look for in tax software that saves time, cuts risk, and keeps you ahead of reporting demands.

Introduction

Markets may be hitting new highs, but the AI-driven opportunity set remains far from tapped. The S&P 500 is trading at a trailing P/E of around 31.5×, well above its historic average of ~16×. Meanwhile, the Nasdaq Composite is near a P/E of 33.6×, reflecting heightened investor optimism. It might feel like the party has already started but in the AI revolution, the real celebration could still be in its early acts. Even as valuations look stretched, stocks such as Taiwan Semiconductor Manufacturing Company (TSMC), Alphabet Inc. and Meta Platforms (Meta) continue to stand out for their scale, AI-era relevance and potential for long-term compounding. They may be trading near all-time highs, yet they aren’t simply riding hype. For example, Alphabet is currently estimated at a forward P/E of about 22.5× for 2026, significantly cheaper than many peers.

In short: yes, the broader market has charged ahead but for investors focused on the AI-megatrend, the momentum may only just be revving up.

1. TSMC - The Unsung King of The AI Chip Supply Chain

TSMC sits at the center of the global AI boom as the world’s most advanced semiconductor foundry. It manufactures the high-performance chips that power industry leaders such as NVIDIA and AMD. With unmatched scale and a dominant share of leading-edge production, TSMC remains one of the most strategically important companies in the world.

1.1 Unmatched Leadership and Scale

Headquartered in Taiwan and dual-listed in both Taiwan and the U.S., TSMC commands the lion’s share of advanced-node chip production. No other player matches its capacity to manufacture the processors that enable modern artificial intelligence, data centers, gaming and mobile computing.

1.2 Financial Strength Funding Future Growth

In 2024, TSMC generated US$90.1 billion in revenue and US$35.5 billion in net income. Its superior gross and operating margins provide a powerful financial engine that supports substantial reinvestment. Few companies globally possess the balance-sheet resilience to fund continuous technological leadership at this level.

1.3 Investing to Reinforce a Powerful Moat

Capital expenditure is projected to climb to US$40-42 billion in 2025, approximately 34 % of expected revenue. The scale of this commitment dwarfs competitors. Intel, for example, expects only US$8-11 billion in net CapEx after incentives. This investment ensures TSMC keeps widening its moat in cutting-edge manufacturing, capacity, and customer stickiness.

1.4 The Technology Leader in AI Fabrication

TSMC’s 2-nm process technology is set to enter volume production in 2025, delivering the industry’s highest transistor density and best power efficiency. This will extend its technological lead by several years. High yields at the most advanced nodes give TSMC a competitive advantage that is difficult to replicate.

1.5 Risks: Cost Pressures and Geopolitics

TSMC’s CapEx intensity requires sustained demand for AI and high-performance chips to ensure robust returns. Facilities being built in the United States and Europe will improve supply-chain resilience, although likely at lower margins than Taiwan-based operations. Rising geopolitical tensions add an additional layer of uncertainty across the semiconductor ecosystem.

1.6 TSMC Valuation Scenario

This chart illustrates how rapidly growing free cash flow, paired with moderate multiple expansion, could drive TSMC’s enterprise value higher over time with the following assumptions:

• Consensus forecasts for revenue, margins, and FCF

• Different cost-of-capital assumptions

• Bear-case downside including geopolitical or yield-risk impacts

• Share count implications for price targets per ADS

1.6 Investment View: Core Enabler of the AI Era

TSMC’s strategic role in the AI revolution is deepening, not fading. Its superior profitability, industry-leading technology and aggressive investment in capacity position the company to remain the indispensable foundry for the world’s most advanced chips. For investors seeking long-term exposure to AI infrastructure, TSMC represents a compelling opportunity backed by durable competitive advantages.

Where to Invest $100,000 According to Experts

Investors face a dilemma. Headlines everywhere say tariffs and AI hype are distorting public markets.

Now, the S&P is trading at over 30x earnings—a level historically linked to crashes.

And the Fed is lowering rates, potentially adding fuel to the fire.

Bloomberg asked where experts would personally invest $100,000 for their September edition. One surprising answer? Art.

It’s what billionaires like Bezos, Gates, and the Rockefellers have used to diversify for decades.

Why?

Contemporary art prices have appreciated 11.2% annually on average

…And with one of the lowest correlations to stocks of any major asset class (Masterworks data, 1995-2024).

Ultra-high net worth collectors (>$50M) allocated 25% of their portfolios to art on average. (UBS, 2024)

Thanks to the world’s premiere art investing platform, now anyone can access works by legends like Banksy, Basquiat, and Picasso—without needing millions. Want in? Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

Meta is transforming from a pure-play social media operator into a fulcrum of the AI economy. The company uses advanced AI tools to enhance engagement and monetisation across platforms such as Instagram, WhatsApp and its original Facebook.

Earlier this year, it launched advertising on WhatsApp over a decade after acquiring the platform. While Meta’s open-source LLaMA model may not yet generate direct revenue, it positions the firm as a leader in AI development and helps attract top AI talent.

2.1 Financial Strength and AI Investment

Meta reported roughly US$164.5 billion in revenue in 2024, with net income exceeding US$62 billion. The company’s capital expenditure in 2025 is projected at US$66‒72 billion, reflecting an AI-infrastructure-heavy agenda that includes data-centres and custom chips. This dual commitment - to profitability and investment reinforces Meta’s capacity to scale.

2.2 Monetising the AI Advantage

Meta’s AI-powered advertising systems are already delivering measurable results. In Q2 2025, its enhanced recommendation model reportedly boosted ad conversions by approximately 5 % on Instagram and 3 % on Facebook. Further innovation is underway across Meta’s ecosystem: AI-video editing tools, the Meta AI chatbot, and smart wearables such as Ray-Ban Meta glasses all feature in the pipeline.

2.3 Risks to Monitor

Heavy investment creates capital-allocation risk: large spending does not guarantee proportionate returns. Unlike peers such as Alphabet Inc. (whose cloud business offers direct monetisation of infrastructure), Meta lacks a significant public-cloud footprint, fewer monetisation channels may amplify risk. Competition is intense across social media and ad platforms (e.g., TikTok, Snap Inc.), which could erode Meta’s advertising dominance.

2.4 Growth Outlook

Analysts at Morningstar estimate Meta’s compound annual sales growth at ≈ 14 % over the next four years. Given the company’s dominant ad ecosystem, expanding user base, and AI investments, many investors view Meta as a compelling long-term play in the AI infrastructure story.

2.5 Meta: AI- Powered Growth Engine

Below is the infographic diagram that visually summarises Meta’s AI growth case with clear typographic hierarchy.

Artificial intelligence is simultaneously a threat and an opportunity for Alphabet. In May 2025, its shares dropped more than 7 % after Apple Inc.’s services executive disclosed that Google searches via Safari declined in April as users gravitated toward AI-based alternatives. Alphabet disputed the claim, but the moment underscored the pressure on its core search business.

Yet search remains Alphabet’s largest revenue engine and it is fighting back. Google has introduced “AI Overviews” within Search to counter rivals such as OpenAI and its ChatGPT platform, reinforcing Alphabet’s positional defence in the AI shift.

3.1 Financial Strength: Fueling the AI Push

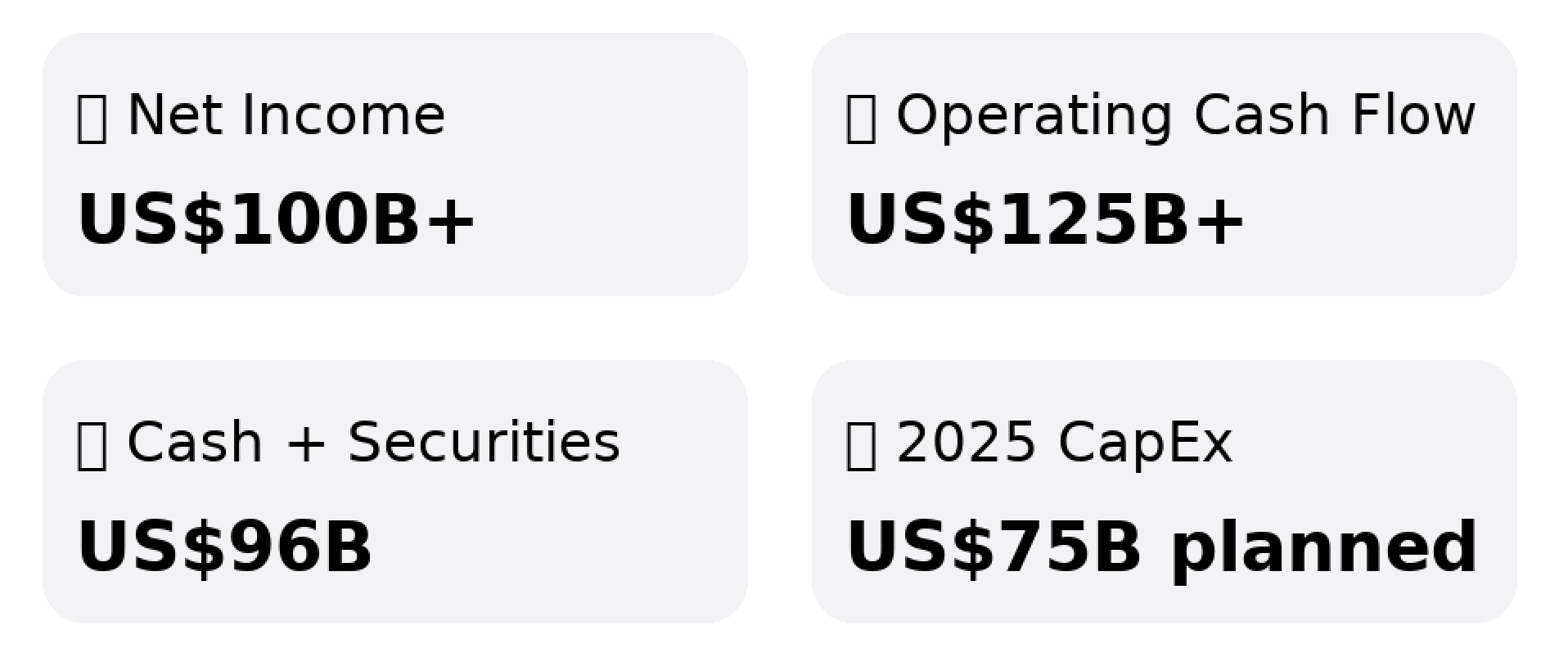

Alphabet reported net income of about US$100.1 billion in 2024. Operating cash flow exceeded US$125 billion in the same period. Its balance sheet is flush with liquidity, with nearly US$96 billion in cash and marketable securities at the end of 2024.

In infrastructure terms, Alphabet plans to spend roughly US$75 billion in capital expenditures in 2025, an investment aimed squarely at AI, cloud and data-centre capacity.

Alphabet: Financial Strength Snapshot

3.2 Innovation in Action

On the product side, Alphabet is pushing into new frontiers. Its video platform YouTube has rolled out more than 30 AI-powered tools designed to improve content creation and engagement. At the same time, its Google Cloud unit is anticipating strong growth, helped by rising enterprise demand for AI-driven services.

3.3 Risks to Watch

Heavy investment carries risk: large outlays will need sustained returns to justify them. Unlike competitors with larger public-cloud businesses, Alphabet continues to rely heavily on its advertising ecosystem—subject to disruption and regulatory scrutiny. Speaking of which, the company faces major antitrust and regulatory challenges globally: although a judge recently declined to break up Chrome or Android in one case, Alphabet still confronts European proceedings under the Digital Markets Act and an ongoing ad-tech investigation.

3.4 Investment Take-away

For investors, Alphabet is more than a search company, it is a foundational player in the AI infrastructure shift. Its deep pockets, legacy dominance and broad technology stack give it high potential upside. However, the mix of regulatory risk, high CapEx and competition means investors must weigh ambition against execution discipline.

Conclusion

Elevated market levels can be intimidating, particularly when valuations appear stretched. However, history has consistently shown that companies delivering durable growth can justify and eventually exceed premium multiples. Investors with long-term horizons possess the advantage of patience, allowing powerful trends to compound.

TSMC, Alphabet, and Meta each represent critical infrastructure providers in the AI era. Their enormous scale, robust balance sheets, and sustained profitability grant them the ability to fund innovation at levels few competitors can match. Together they are projected to deploy more than US$180 billion in capital expenditures during 2025, a transformative investment that may compress margins in the near term but aims to unlock multi-year growth across semiconductor manufacturing, AI-enabled advertising, and cloud computing.

Happy Investing!

Recommended Resource 1

An Investment into Your Financial Freedom 💰💰

Are you tired of spending endless hours watching webinars, only to find that knowledge gathering dust in the back of your mind?

Introducing the Super Investor Club—designed to transform how you learn about investing. This hands-on approach makes financial education engaging and accessible for everyone, whether you're a seasoned trader or a casual investor.

Imagine having the tools and knowledge to make informed investment decisions that can lead to true financial freedom. With the Super Investor Club, you’ll be part of a community dedicated to your financial success, learning from experts and applying strategies that work.

Don’t just join a membership—invest in your financial education and future.

Disclaimer: The information provided in this article is for educational and informational purposes only and should not be construed as investment advice. The views expressed are those of the author and do not necessarily reflect the official policy or position of any company. Readers should do their research before taking any actions related to the content. The author and publisher are not liable for any losses or damages caused by following any advice or information presented herein. Unveiling the Secrets of Growth Stock Investing!