- LifeVest Newsletter - Build Wealth Protect Wealth

- Posts

- Treat Yourself: Winter Joy in Summer!

Treat Yourself: Winter Joy in Summer!

Exciting News

Turn AI Into Your Income Stream

The AI economy is booming, and smart entrepreneurs are already profiting. Subscribe to Mindstream and get instant access to 200+ proven strategies to monetize AI tools like ChatGPT, Midjourney, and more. From content creation to automation services, discover actionable ways to build your AI-powered income. No coding required, just practical strategies that work.

Introduction

Investing in stocks is an exhilarating journey, with each chart revealing new opportunities. 2 of our stocks soared more than 10% in a single trading session, powered by stellar earnings results.

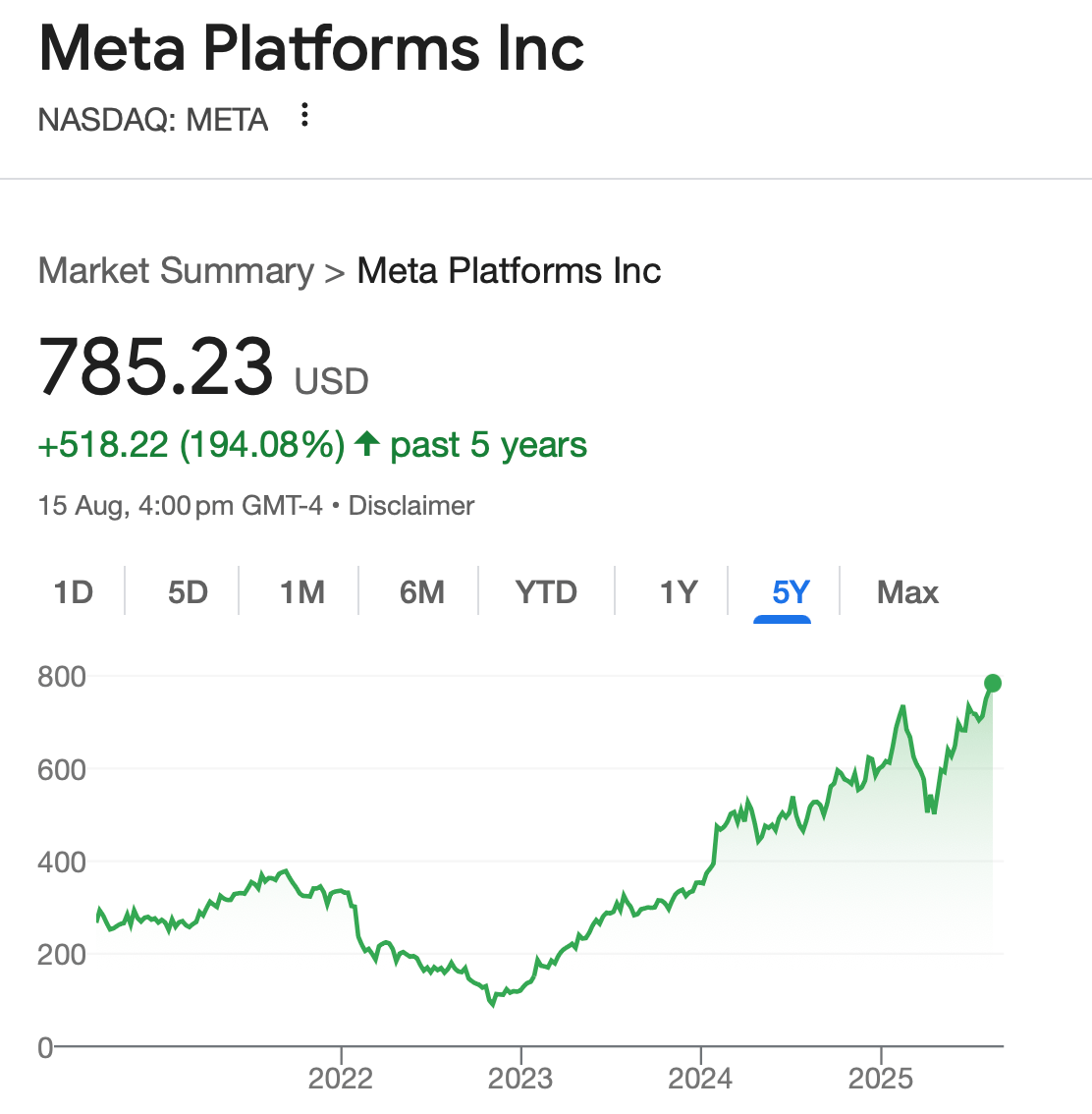

One of them was Meta Platforms. While a one-day double-digit gain grabs headlines, the bigger story is this: Meta has already delivered over 100% returns for the portfolio—yet the growth story may still be in its early chapters.

There are some lessons here we want to share.

Catch the Bargain Wave!

Back in early 2022, Meta Platforms looked like it could do nothing right.

Facebook reported its first-ever decline in daily active users, losing 1 million users in Q4 2021.

Rival TikTok was exploding, drawing in younger audiences and dominating screen time.

Apple dealt a heavy blow with its iOS privacy changes, cutting Meta off from user data that powered its targeted advertising. The company itself warned of a US$10 billion revenue headwind in 2022 from these restrictions.

To make matters worse, Meta issued a tepid forecast, projecting just 3%–11% revenue growth for Q1 2022, its slowest ever pace.

Investors panicked. The stock crashed more than 20% in a single day, wiping out over US$230 billion in market value—the largest one-day loss ever for a U.S. company at the time.

Strengthening Confidence Gradually

Here’s what most people don’t tell you. When the news is bad, there is no one around to tell you the good news. You have to look for it yourself.

It also wasn’t the first time the social media giant had run into trouble. And here’s the key lesson I’ve learned: you need to be willing to look past the dark clouds to uncover the truth.

Sure enough, the good news started to surface.

In 1Q 2022, Meta revealed that its “click-to-message” ads—a clever workaround to Apple’s privacy restrictions—had quietly grown into a multi-billion-dollar business.

Within just a year, this revenue stream had ballooned into a US$10 billion run-rate business—an incredible achievement that barely made a blip in financial headlines.

And Meta was only warming up.

By 2Q 2023, Reels—its TikTok rival—skyrocketed from virtually nothing to a US$10 billion revenue run-rate.

Just one quarter later, Advantage+ Shopping, Meta’s AI-powered ad solution, hit another US$10 billion in annualised sales.

Fast forward to the end of 2024, and Advantage+ had doubled that figure to a US$20 billion run-rate.

Meanwhile, Meta’s share price staged a remarkable comeback, climbing from the depths of its 2022 selloff to deliver triple-digit percentage gains.

And yet, despite these seismic shifts in its business model, the financial media remained largely silent. The headlines focused on setbacks, not on the steady march of innovation and monetisation driving Meta’s rebound.

That’s the hidden edge in investing—true opportunity rarely makes the front page.

Seize the Moment for Peak Gains

Here’s something worth noting: even after Meta’s rebound, we kept accumulating shares through 2023 and 2024.

Why buy when prices were climbing? The answer is simple: those 3 revenue streams weren’t one-off flukes. They were durable growth engines that would keep powering Meta’s topline for years.

And importantly, shares were still attractively valued. Back in July 2024, Meta stock was trading at just 22 times forward earnings—well below its five-year historical average of ~28x. By comparison, peers like Alphabet and Microsoft were trading closer to 25–30x.

The reaction at the time was predictable. Many argued that once a stock appears in mainstream headlines, it’s already “too late.”

But fast forward to today—Meta just crossed US$770 recently. That’s nearly a 60% gain in just over a year. The real risk isn’t buying too late—it’s letting the stock price alone dictate your decisions, instead of the fundamentals driving it.

💡 Investor Lesson: Price Isn’t Value

Headlines ≠ truth: Financial media often highlight problems but overlook emerging revenue streams.

Valuation matters: A stock trading below its historical average P/E while growing new billion-dollar businesses can still be a bargain.

Think long-term: Durable revenue drivers like Click-to-Message, Reels Ads, and Advantage+ Shopping were clear growth engines—if you looked past the noise.

Top Priority: Get Smart with Stock Ownership

Peter Lynch once said that “the best stock to buy is the one you already own.”

He makes a great point.

Here’s why: when you stick with a business through thick and thin, you gain insights that casual traders or early sellers will never see. You start to understand how a company navigates challenges, what it takes to stage a turnaround, and why it ultimately prospers.

That accumulated mileage becomes an investing advantage. It sharpens your judgment—not only when the company is thriving, but also when it stumbles.

And here’s the kicker: everything I’ve shared about Meta’s transformation is public information. None of it was hidden.

So why did so many naysayers miss the story?

Because most investors who sell during a downturn never look back. They write the stock off, blind to the fact that businesses evolve and momentum shifts.

The truth is, noticing these changes requires patience, conviction, and a willingness to pay attention when everyone else has tuned out.

💡 Investor Takeaway:

Great returns often come not from constantly chasing the next “hot” stock, but from having the discipline to hold the right one long enough to see its full story play out

Conclusion

In the end, investing is as much about patience and observation as it is about numbers. By staying committed, studying the business closely, and recognizing its evolving momentum, you position yourself to benefit from opportunities that others overlook. Those who sell in haste often miss the real story — and the potential gains. The lesson is clear: informed perseverance can turn market noise into long-term reward.

Happy Investing!

Start learning AI in 2025

Keeping up with AI is hard – we get it!

That’s why over 1M professionals read Superhuman AI to stay ahead.

Get daily AI news, tools, and tutorials

Learn new AI skills you can use at work in 3 mins a day

Become 10X more productive

Disclaimer: The information provided in this article is for educational and informational purposes only and should not be construed as investment advice. The views expressed are those of the author and do not necessarily reflect the official policy or position of any company. Readers should do their research before taking any actions related to the content. The author and publisher are not liable for any losses or damages caused by following any advice or information presented herein. Unveiling the Secrets of Growth Stock Investing!